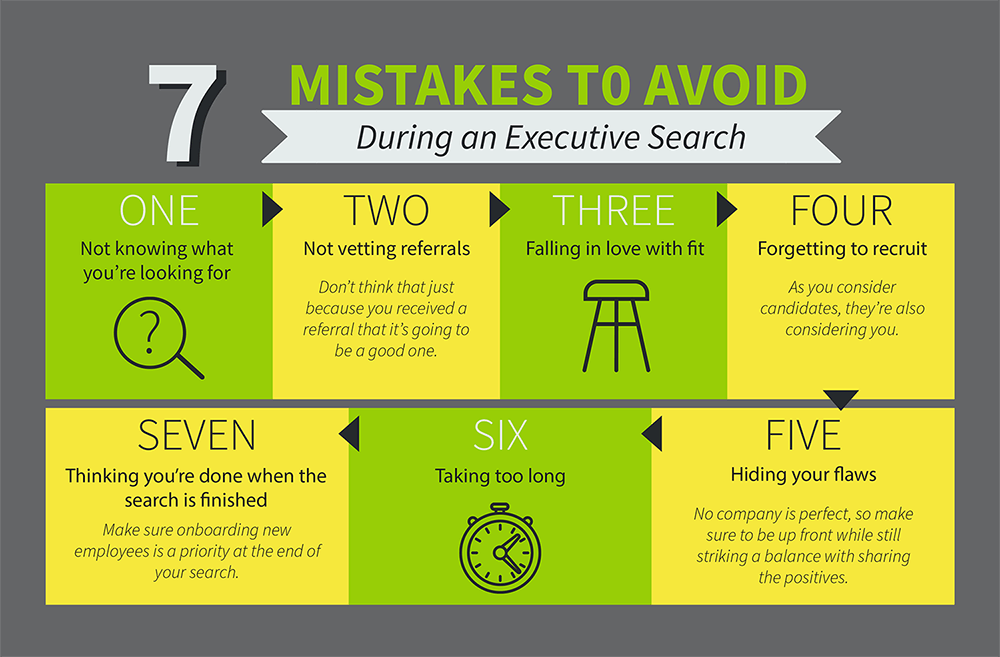

7 Mistakes to Avoid During an Executive Search

From identifying qualified candidates to conducting effective interviews to negotiating offers, executing an executive search means coordinating a lot of moving parts. Even the best-run searches face a few challenges along the way.

If you plan the process thoughtfully, though, you can avoid these obstacles and conduct a smooth and successful executive search.

Today we’ll outline 7 mistakes that can derail an executive search. We’ll also talk about a few precautions you can take to help you avoid them.

Not knowing what you’re looking for

If you don’t know what you’re looking for in a candidate at the beginning of an executive search, how will you ultimately identify, interview and select the right professional for the position?

Organizations often make the mistake of jumping straight into creating the job description, focusing on job responsibilities and candidate qualifications.

A better approach is to start by creating alignment of the key roles and responsibilities. Ask all key stakeholders the simple question, “What will this position achieve?”. This will help you gain a better understanding of how your organization will define success for the role as well as the obstacles your new hire will need to overcome.

How to avoid this mistake

Create a Success Profile focusing on the soft skills needed for a new hire to be successful and provide a guideline showing how interview teams should evaluate candidates for these skills.

Not vetting referrals

Nearly 80% of internal recruiters report that the most qualified candidates come from employee referrals. But don’t assume every referral is a good one.

Referrals and internal candidates should be subject to the same interview process as external candidates. Using a consistent process will ensure confidence in your final selection.

Falling in love with fit

Organizational fit is crucial when hiring new executives, but a candidate who is a perfect fit culturally may not be able to perform the job successfully. When evaluating candidates for a position, remember the “three legs holding up the Recruiting Stool”:

- Does the candidate have the skills to do the job?

- Is the candidate motivated to do the job?

- Is the candidate a good culture fit?

Your top candidates need to have the skills and motivation to do the job as well as be the right fit for your organization.

How to avoid this mistake

Use the Success Profile to develop questions ahead of time that help evaluate the candidates for each “leg of the stool.” Most companies feel that they do a good job evaluating for fit and technical ability, but figuring out if candidates are motivated to do the job takes a little more probing.

Gaining an understanding of why candidates make certain moves in their career, why they were promoted and why they are interested in your role can help paint a picture of their motivation.

Forgetting to recruit

As you consider candidates throughout the search process, remember: they are also evaluating you.

High-level professionals want to know if joining your company is the right move for them, so providing them with the right information to make their decision is absolutely necessary.

Moreover, executives want to be recruited. Senior-level candidates not only have limited time to apply for positions but also need to know that they are wanted by a company before pursuing an opportunity.

How to avoid this mistake

Remember that interviews aren’t a one-way street. During the interview process, plan a tour so candidates can see your organization and build in opportunities for them to ask questions.

Also, before the interview, make sure all of your interviewers are able to answer the question, “Why are you here?” Your company’s executives should be able to convey to candidates why they joined the company, where they see the organization going and how this role fits into their long-term vision.

And make sure to conduct candidate surveys at the end of the interview process to improve the candidate experience for the future.

Hiding your flaws

Not being transparent with candidates is a big mistake that can cost you later in the process.

Challenges or issues facing the role or organization are bound to come out. It’s better for candidates to hear about those issues from you rather than a third party.

No company is perfect, so make sure to be up front while still striking a balance with sharing the positives.

Taking too long

Time kills all deals. If a position is open too long, you may lose candidates, or the people in the marketplace may begin to wonder if there’s something wrong with the role or company.

How to avoid this mistake

Create a realistic timeline for your search, noting milestones like the completion of sourcing phases, interview dates and a goal start-date.

You may diverge from your plan, but try to stick to it as much as possible during the search.

Thinking you’re done when the search is finished

Once you’ve made a successful hire, you may be tempted to think you’ve completed your work, but don’t be fooled. As many as one-third of new hires quit within the first 6 months of starting a job.

In order to retain your new talent, make sure onboarding new employees is a priority at the end of your search.

How to avoid this mistake

Create a New Hire Orientation program that introduces new members to your team and allows them to learn more about the organization when they join.

Including a “New Hire Checklist” helps make sure new employees have all of the supplies and technology access they will need for their job. First impressions are important, so make Day 1 a positive experience for your new team members.

What challenges are you worried about?

Are you planning an executive search? If so, keep in mind that mistakes do happen, but being aware of them and taking steps to correct them ahead of time will lead to an efficient and effective executive search.

If there are challenges you’re worried about, or you’d like to know more about how 180one can help make your next executive search a success, just email us. We’d love to help!