Water Cooler wisdom

Year in review

Recent posts

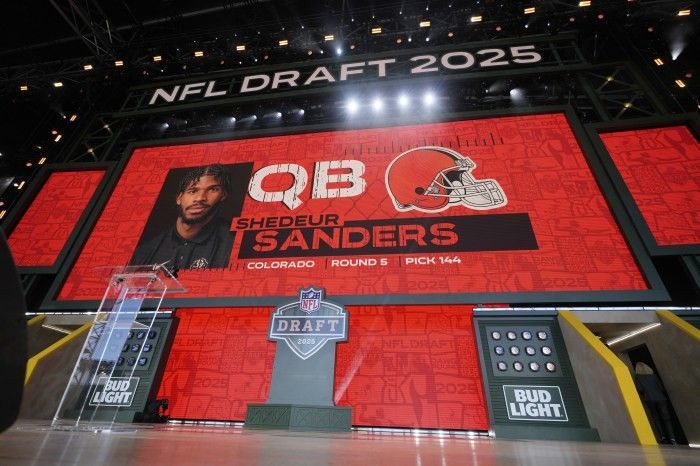

In the 2025 NFL Draft, Shedeur Sanders, once projected as a top five pick, experienced a surprising fall to the fifth round before being selected by the Cleveland Browns. This unexpected drop raised questions about his draft stock and the factors influencing team decisions. Despite his impressive college career, including setting school records and other accolades, Sanders' draft experience underscores a crucial lesson for companies: hiring decisions are multifaceted and not solely based on past performance or potential. Just as NFL teams must consider various factors beyond a player's statistics, businesses should adopt a comprehensive approach to hiring, evaluating candidates holistically to ensure the best fit for their organization's needs. While the NFL Draft might just look like a televised event where young athletes get picked by professional teams, beneath the fanfare is a highly strategic, data-driven process that offers invaluable insights into one of the most important business practices: hiring . If you're in the corporate world and responsible for recruiting talent—whether you're a founder, HR executive, or team leader, there's a lot you can learn from how NFL teams approach drafting. Let’s explore how this intense, high-stakes selection process mirrors and can elevate traditional corporate hiring. Understand What You’re Hiring For The first step in great hiring is clarity. In one NFL team, draft results consistently lagged for one side of the ball. A simple survey revealed why: there was zero consensus among scouts and coaches about what success looked like at a key position. Without a shared vision, decisions were scattershot. In business , the same thing happens. Teams rush to hire without aligning on goals. Do you need a disruptive innovator or a steady team player? A generalist or a deep specialist? Skipping this conversation sets you up to fail. Tip : Clearly define roles with specific traits, values, and performance goals before interviewing even begins. Structure Beats Technology Despite all the tech, there’s no magical algorithm that guarantees a good draft pick. What separates the top NFL teams is process , consistent, disciplined evaluation systems. The same principle holds true in business. Unstructured hiring decisions are noisy and prone to bias. Managers get influenced by irrelevant factors: a great handshake, a shared alma mater, or how the last interview went. Consistency comes from structured scorecards, checklists, and predefined evaluation criteria. Tip : Use structured interviews and weighted scorecards to keep evaluations focused and replicable. Keep Evaluators Independent One underrated tactic NFL teams use: separating scout opinions. Some teams purposely blind scouts to each other's evaluations to preserve independent judgment. That’s critical, because once someone hears a strong opinion, they’re prone to “anchor” on it, consciously or not. In corporate hiring , it’s the same story. If the first interviewer gushes about a candidate, others may unconsciously lower their guard. True diversity of opinion only exists if assessments are made independently. Tip : Have team members submit their evaluations separately before group discussions. Interviewing is Like the Combine – But Not Everything The NFL Combine is a week-long showcase where draft prospects go through physical and mental tests. But teams don’t draft solely based on who runs the fastest 40-yard dash. They look at long-term potential, game tape, and coachability . In companies , i nterviews are important, but they’re just one part of a broader evaluation. Candidates may be nervous, overly rehearsed, or misrepresent their skills. Supplement interviews with trial projects, references, and past performance reviews. Tip : Give candidates real-world problems to solve that mimic the work they’ll be doing. Fit Over Flash Some of the NFL’s biggest draft busts were players with jaw-dropping athleticism who simply didn’t fit into the team’s system. Conversely, many late-round picks became legends because they were a great fit for a team's specific needs and culture. In business , skills can be taught, but cultural fit, adaptability, and motivation are harder to instill. Ask: Will this person thrive in our environment? Will they complement our team dynamics? Tip : Ask culture-focused questions and involve future teammates in the interview to assess chemistry. Break Candidates into Components NFL teams don’t evaluate a player as just “good” or “bad.” They break skills down: footwork, decision-making, toughness, coachability. Then they score each attribute separately. In hiring , we often rely on vague impressions. But global ratings are prone to bias and inconsistency across interviewers. Instead, decompose the job into core competencies—communication, technical ability, leadership, and score each explicitly. Tip : Break job performance into 4–6 distinct traits and rate each on a consistent scale. Rebuild the Full Picture- Mechanically After breaking down a candidate’s attributes, NFL teams reassemble their evaluations into an overall rating. Some simply average scores across scouts. It might sound simplistic—but it’s surprisingly effective. In companies , intuitive judgment often dominates. The loudest voice or most senior person can sway the group. Instead, use aggregated, weighted scores as a starting point. It creates a more objective, repeatable process. Tip : Let the data guide your shortlist, then use discussion to refine (not override) decisions. Data-Informed Decisions Are Key NFL franchises now use advanced analytics to measure player performance in ways the eye test alone can’t. From GPS tracking of player speed to AI-assisted video analysis, decision-makers are armed with data. Lesson for companies : Go beyond gut feelings and use structured hiring practices . Utilize assessment tools, skill tests, and personality inventories. Tip : Implement scorecards during interviews and pre-hire assessments for objectivity. High Draft Pick ≠ Guaranteed Success Tom Brady was a sixth-round pick. Kurt Warner went undrafted. Meanwhile, many five-star athletes flamed out. The lesson? Success isn’t always visible on a resume. In hiring , don’t over-rely on pedigree. Grit, curiosity, and coachability are better predictors of future success than past prestige. Tip : Ask candidates about setbacks, learning moments, and how they seek feedback. Final Whistle There is no silver bullet for hiring- no AI tool, test, or gut instinct that will always get it right. But there is a better way: a repeatable, structured, thoughtful process . The NFL Draft, for all its hype, works because the best teams stick to principles: define goals, evaluate consistently, prioritize fit, and learn over time. These same principles can help any organization—from startups to Fortune 500s—build stronger teams and better futures. So next April, when the draft rolls around, don’t just watch for your favorite team’s pick. Take notes. Because if you want to win the talent game, the playbook is already out there.

Chief Financial Officer ABOUT THE COMPANY Founded in 1947, Oregon Tool, Inc. has grown from a basement in Portland, Oregon, to a global designer, manufacturer, and marketer of precision cutting tools, equipment, and accessories for consumers and professionals in more than 110 countries with 3200 team members. Building off the pioneering spirit of its founder, Joseph Buford Cox, Oregon Tool has transformed the cutting industry and have become the world’s #1 manufacturer of saw chain and guide bars for chainsaws and diamond saw chain for concrete and pipe, a leading manufacturer of agricultural tractor attachments, and the leading OEM supplier of first-fit and replacement parts. Its products are sold into the aftermarket through multiple channels, including distributors, dealers, mass merchants and e-commerce, as well as to original equipment manufacturers for “first fit” use on new equipment. Since its founding in the 1940s, Oregon Tool has grown from a family business into a multinational organization. Oregon Tool is owned by Platinum Equity, a global investment firm with more than $48 billion of assets under management and a portfolio of approximately 60 operating companies that serve customers around the world. Platinum Equity specializes in mergers, acquisitions and operations – a trademarked strategy it calls M&A&O® – acquiring and operating companies in a broad range of business markets, including manufacturing, distribution, transportation and logistics, equipment rental, metals services, media and entertainment, technology, telecommunications and other industries. Over the past 29 years Platinum Equity has completed more than 450 acquisitions. POSITION SUMMARY Based on a recent promotion of Oregon Tool’s Chief Financial Officer to Chief Executive Officer , Oregon Tool is seeking an experienced Chief Financial Officer (CFO) to lead all financial functions across our U.S. and international operations with a team of over 140 members. The CFO will be a key strategic partner to the executive leadership team, playing a pivotal role in shaping the company’s growth strategy, ensuring financial performance, managing risk, and overseeing the IT function. As the financial steward of a private equity-backed global organization, the CFO will manage financial operations, optimize cash flow, oversee budgeting and forecasting, and support operational efficiency. The CFO will also be responsible for aligning the finance and IT teams with the strategic vision set by the private equity owners, helping to drive value creation, cost optimization, and scalability. KEY RESPONSIBILITIES Strategic Financial Leadership: Develop and execute the financial strategy to support both short-term and long-term growth objectives, aligning with the playbook. Drive strategic financial planning, providing insights on capital structure, liquidity, and funding strategies. Partner with the executive leadership team to guide business performance, identify operational efficiencies, and drive margin improvements. Support the execution of an exit strategy or liquidity event, working closely with the private equity firm to align with investment objectives. Financial Operations & Reporting: Oversee the preparation of financial statements in accordance with U.S. GAAP and international standards, ensuring compliance with regulatory requirements across all jurisdictions. Lead monthly, quarterly, and annual financial reporting to the private equity firm, board of directors, and other key stakeholders. Implement best practices for financial reporting and performance analysis, ensuring the company maintains a strong financial position. Direct the finance team in all areas of financial operations, including accounting, financial reporting, budgeting, and tax compliance. Cash Flow & Risk Management: Manage the company’s cash flow, working capital, and liquidity to ensure the business operates efficiently and remains financially stable. Develop and implement risk management strategies, overseeing financial controls, insurance, and mitigation of operational, financial, and market risks. Work with external auditors, legal advisors, and tax consultants to manage risk and optimize the tax structure across global operations. This includes cyber security and IT Risk Management. Mergers & Acquisitions (M&A) and Capital Strategy: Lead or support M&A initiatives, including target identification, due diligence, valuation, and integration, to support the company’s growth strategy and value creation. Partner with the private equity firm to evaluate and execute on new investment opportunities, optimizing capital structure and aligning with the firm’s strategic priorities. Global Operations & International Oversight: Oversee financial operations in all international locations, ensuring compliance with local financial regulations and tax laws. Maximize financial processes and reporting systems across geographies, driving operational efficiencies and consistent decision-making globally. Coordinate with international finance teams to ensure alignment with overall company financial objectives and adherence to best practices. IT Strategy & Oversight: Lead the IT function, aligning technology investments with financial goals and operational needs. Ensure systems are scalable, secure, and enable financial reporting and forecasting capabilities. Partner with the IT team to ensure the integration of financial systems (e.g., ERP, cloud services) to enhance reporting accuracy and streamline operations. Drive initiatives that optimize the company’s technological infrastructure, ensuring it supports both financial and operational goals, particularly in the context of global manufacturing and sales. Leadership & Team Development: Build and lead a high-performance finance team, providing mentorship and fostering professional growth opportunities. Develop strong relationships with cross-functional teams to ensure finance is closely integrated with all business operations. Collaborate with the leadership team to set the overall direction for the business, ensuring that financial goals are met and exceeded. ESSENTIAL DUTIES AND RESPONSIBILITIES Financial Reporting Oversee the preparation and accuracy of consolidated financial statements in compliance with U.S. GAAP, IFRS, and other relevant international accounting standards. Ensure timely and accurate monthly, quarterly, and annual financial reporting for internal and external stakeholders. Manage the preparation and production of consolidated financial reports adhering to internal reporting deadlines. Interface with external auditors on the timing and coordination of the year-end audit and work closely with them throughout their audit cycle. Develop and communicate the reporting schedule internally to Oregon Tool locations and facilitate compliance with reporting deadlines. Streamline and provide continual improvements to the master closing package template utilized by all reporting units. Lead and manage the external reporting cycles in an accurate and timely manner to achieve compliance with debt covenants and reporting deadlines including preparation of financial statements and footnotes. Ensure that the reporting system is able to produce financial information in the format and configuration required by senior management. Accounting Operations Lead the North America accounting team, ensuring accurate and efficient day-to-day accounting operations. Oversee the monthly and year-end close processes, ensuring timely reconciliations, accurate journal entries, and adherence to closing schedules. Ensure compliance with internal controls, policies, and procedures to safeguard company assets. Maintain and monitor an effective system of internal accounting and financial reporting controls. Interpret and analyze and report on periodic results. Maintain an internal performance management reporting system. Provide accounting direction and support to company-wide reporting units. Manage the collection and consolidation of data from company-wide reporting units. Supervise the general ledger for various accounts and legal entities, ensuring the accounting records are accurate and well documented. Lead continuous improvement efforts to improve processes and shorten reporting cycle times. Maintain, update and improve policies, processes, and systems including automation of key activities. Team Management Lead, mentor, and develop the management teams across CP, Mold, and PD, ensuring accountability and high performance. Establish clear performance metrics and KPIs for all areas of the business to drive results and enhance team collaboration. Maintain good communication, promote problem-solving, assign responsibilities, and provide training and mentoring to employees. Select and develop key operational executives and successors, assign accountabilities, set objectives, and establish priorities. Team Leadership and Development Lead, mentor, and develop a high-performing accounting team. Foster a culture of continuous improvement, promoting efficiency, accuracy, and best practices. Manage performance, establish clear development goals, and provide ongoing coaching for team members. Lead documentation and continual improvement of departmental work processes. QUALIFCATIONS • Minimum of 5-7+ years of experience in executive financial leadership positions, with a focus on manufacturing, sales, and international operations. • Prior experience in a private equity-backed company is highly preferred, with a proven track record of driving growth and value creation. • Strong experience in M&A, capital structure optimization, and working closely with private equity investors. • Experience in capital markets managing banking and investor relations. • Strong financial modeling, analysis, and business forecasting skills. • Expertise in U.S. GAAP, IFRS, international financial regulations, and tax compliance across multiple jurisdictions. • Experience in IT or Business Analyst management, optimizing global systems, ERP software, and other integrated technologies. • Excellent leadership skills, with the ability to motivate and develop high-performing teams in a fast-paced, growth-oriented environment. • Ability to communicate complex financial concepts clearly to both financial and non-financial stakeholders, including the private equity investors. LEADERSHIP COMPETENCIES Strategic Orientation & Commercial Acumen The ideal candidate will have a strategic mindset and will look at business challenges and opportunities in a holistic way. With that strategic mindset, executing on the existing Playbook is the priority. They will understand how to integrate market and competitive trends, organizational state, and other issues into a coherent vision for change and growth and link this vision into a series of initiatives and priorities that are compelling and logical. They will have a strong track record of driving growth and value through internal initiatives. Execution / Results Orientation The ideal candidate will have a demonstrated track record of delivering impact in the business. The individual must have a high sense of urgency, be a highly driven execution- oriented leader who has repeatedly led organizations through rapid transformation that yield increased levels of growth and sustainable performance. They will have the ability and determination to move a portfolio of strategic imperatives forward, using performance metrics and benchmarks to track progress. Team Leadership / Talent Development The candidate will build deep organization strength, inspire and motivate the entire organization to impact the future growth, continuity and profitability of the business. They should be focused on coaching, mentoring and testing their senior leadership team to ensure continued growth and success of the business. The leader will consistently be recruiting to benchmark their existing team and as needed, bring in best-in-class performers. The ideal candidate will possess the ability to effectively motivate others to achieve goals and objectives as they build the next level leadership talent. Collaboration, Communication & Influencing The leader will be a good listener with outstanding interpersonal qualities and a natural, effective consultative style. They will have demonstrated the ability to be straightforward, frank, and direct with others while communicating respect. They must be able to influence, collaborate and partner with the different entities to drive improvements. This includes the ability to work effectively with a virtual, geographically dispersed organization. Interested in Learning More? 180one has been engaged by Oregon Tool to manage this search. If interested in learning more about the opportunity, please contact Matt Oltmann /971.235.6236/ matt.oltmann@180one.com .

180one is pleased to announce our recent partnership with Pike Street Capital and the successful placement of a new Board Member for Superior Duct Fabrication, a Pike Street portfolio company! Superior Duct Fabrication is a leading provider of commercial and industrial HVAC duct systems, known for its high-quality fabrication, reliability, and customer service. The company serves a wide range of industries, delivering complex ductwork solutions with precision and speed. Pike Street Capital, a Seattle-based private equity firm focused on industrial growth companies, acquired Superior Duct Fabrication as part of its strategy to invest in scalable, high-performing manufacturing businesses. Pike Street partners with management teams to accelerate growth and build long-term value through operational improvements and strategic leadership. As part of this effort, Pike Street Capital partnered with 180one to recruit a new board member to help guide Superior Duct’s continued expansion and success. Congratulations to Pike Street Capital, Superior Duct Fabrication, and the 180one Search Team on a successful board placement!

Let’s face the music, or the new reality that attracting executives to move across the country for an opportunity has become increasingly difficult for a variety of circumstances. As businesses look to recruit top talent at executive levels, understanding the shifts in migration trends before you launch a search, better yet, as you plan a position, might be the difference of landing a great candidate in a reasonable amount of time, or dragging out a search for the unicorn who can’t be found. Let’s look at some of the factors and trends together that might shape how your organization moves forward in conducting a national executive search. Understanding the 2024 Relocation Landscape The 2024 Allied Migration Report paints a picture of a U.S. population increasingly seeking affordable living spaces, a better work-life balance, and more favorable economic conditions. Despite a 20% overall decrease in interstate relocations from 2022 to 2024, the main driver of those relocating is the alignment of their personal and professional goals. The report also underscores the shift toward midsize cities and suburban areas as more desirable destinations. This trend is being driven by a combination of rising housing costs in major cities, economic uncertainty, and a greater demand for improved quality of life. Companies looking to relocate candidates must consider a range of factors to ensure that they are not only attracting talent but also providing a work environment that matches these evolving preferences. Here are 5 key aspects that companies should score themselves against to determine how desirable their location is for the market. Depending on how one scores, it can help highlight the probability of relocating or needing to adjust the candidate profile to match candidates in the current geographic market not needing relocation. 1. Housing Affordability and Living Costs One of the most significant motivators for relocation in 2024 is housing affordability. In 2023, soaring housing costs in urban centers like San Francisco, Los Angeles, and Chicago pushed many people to consider smaller cities and suburban areas where the cost of living is lower. When relocating candidates, it's crucial for employers to consider how the cost of housing in their city or region will impact the candidate’s overall financial well-being. If your company is in a higher cost area, providing a sign-on bonus towards housing can be one lever to pull to cover the gap. 2. Remote Work and Flexible Work Arrangements The rise of remote work in the wake of the pandemic continues to shape relocation patterns. With many employees now able to work from anywhere, some candidates are looking for jobs that allow them to live in more affordable or attractive locations while still benefiting from a competitive salary. The ability to work from home (or a hybrid model) has made relocation less about proximity to the office and more about finding a place that offers a better quality of life. For employers, it’s essential to evaluate whether the role can be offered remotely or with flexible work arrangements. If the company is headquartered in a high-cost city but allows employees to work from anywhere, the business might be able to attract candidates from more affordable regions while offering competitive salaries. On the other hand, if the position requires in-office attendance, it’s important to highlight the benefits of relocating to that city—such as lifestyle factors, community offerings, and career advancement opportunities. 3. Job Market and Industry Opportunities Candidates are increasingly moving to regions where job markets are thriving, particularly in industries like technology, renewable energy, healthcare, and finance. The 2024 Allied Migration Report noted that states with growing job markets are experiencing strong inbound migration. How would classify your region’s overall job market? Candidates want to know that if they were to relocate, and for some reason down the road they leave the organization – what other opportunities exist for them locally. If there are no other reasonable and likely options related to their industry, or expertise - this can pose another hurdle that needs to be addressed. It’s essential to evaluate whether the region offers the kind of industry opportunities that will keep the candidate’s career trajectory on track. 4. Tax Policies and Financial Incentives Tax policies are a key factor influencing relocation decisions in 2024. States with no income tax have seen an increase in inbound migration, with people moving to these states in search of more disposable income. The economic uncertainty and high inflation rates in 2024 have made individuals more conscious of their financial situations, and tax-friendly states are becoming increasingly attractive. Employers looking to relocate candidates should consider the tax implications of moving employees to specific regions. 5. Quality of Life and Lifestyle Considerations Beyond financial factors, candidates are also considering lifestyle factors when deciding where to relocate for work. According to the 2024 Allied Migration Report, many people are moving to regions that offer a better balance of work and life, which includes access to quality healthcare, good schools, recreational activities, and a desirable climate. For employers, this means understanding the lifestyle preferences of potential candidates and emphasizing how the region supports these needs. What’s the Score? So how did your region score? How will it impact how you go to market with the position? Did you adjust the candidate profile to mirror what exists in the local candidate market, or is your region highly desirable to attract the unicorn? As migration patterns evolve, companies that adapt their candidate profiles and expectations to these shifting dynamics will be well-positioned to thrive in an increasingly mobile workforce.

Corporate Development Manager About the Company Impel is a family of companies that offer comprehensive flow management solutions in partnership with each other and the best manufacturers in the world. Each of Impels branches represent individual brand cultures and span the West Coast. Impel serves customers in water, wastewater, agriculture, industrial, manufacturing, energy and mining. Impel was founded in 2021 with a vision to build a “one-stop shop” to serve municipal and industrial fluid management needs by acquiring complementary capabilities in contiguous geographies. The platform launched with the first acquisition of PumpTech , a premier distributor of high-quality pumping products and systems serving the Pacific Northwest. Subsequent acquisitions have grown Impel to over ten fluid management companies throughout the US. Impel is backed by Pike Street Capital , a private equity firm based in Seattle, WA. Recently, Pike Street successfully raised capital to fund additional acquisitions. Impel is actively pursuing growth opportunities and remains focused on acquiring and partnering with family-owned and operated companies in the sector. About the Role This is a key position managing the acquisition process within Impel. You will participate in all aspects of the investment process including industry/market research, deal origination, strategy and execution, and relationship building with acquisition target owners, executives, investment bankers and other intermediaries. This is a great role if you’re looking to own the deal process and progress your skillset as a deal professional. This role will give you deep insight into the entire acquisition process while closing multiple deals a year. We are a fairly lean team and believe in cross functional work so come with a growth mindset and you will develop a skillset across each business function; Our team believes in developing our team members. Primary Responsibilities Perform company analysis, including initial screenings, financial modeling and valuation, due diligence, consultation with external advisors, and preparation of materials for internal investment meetings. Responsible for M&A project management processes to include, but not limited to, valuations, letters of intent, due diligence analysis, financial planning, and business case development. Analysis of risks and opportunities of M&A activities, translate this into fact-based and well-reasoned insights on the valuation and structural impact of various acquisitions. Drive market research and strategic fit analysis. Conduct research on prospective sector opportunities and market trends and develop and present data-based opinions to inform decision-making and price transactions. Participate on deal teams to help structure and execute transactions, including coordinating the deal process and legal and transactional documentation. Special projects working directly with C suite, functional leads, and regional vice presidents. Qualifications 2-6 years experience in private equity, consulting, financial DD/QoE, investment banking, accounting, or corporate M&A Exposure to other diligence areas including commercial, operational, market sizing, risk analysis, customer and supplier, agreement review, etc. Excel and PowerPoint expertise Value oriented Strong communication skills Commitment to high professional standards Credentials: CPA preferred Interested in Learning More? 180one is a retained search firm and has been engaged by Impel to manage this search. If interested in learning more about the opportunity, please contact Tom Haley /503.334.1350/ tom@180one.com

Long Term Incentive Plans (LTIPs) and Why to Implement Executive compensation is a nuanced and multifaceted subject that involves a delicate balance between rewarding top talent and aligning their interests with the long-term success of the organization. Typically, executive pay packages consist of three primary components: base salary, annual bonuses, and long-term incentive plans (LTIPs). While base salary and annual bonuses have historically been the most visible and commonly discussed elements of executive compensation, LTIPs are increasingly being recognized as the third and arguably most important leg of the stool. LTIPs serve as a tool for aligning the goals of executives with those of the company over the long term, offering rewards that are tied to the sustained growth and profitability of the organization. As businesses evolve and face growing challenges, LTIPs have become a central component in shaping how executives are compensated, ensuring they remain focused on creating long-term shareholder value. Over the past 75 years, LTIPs have been a common feature in public companies, where stock options, performance shares, and other equity-based incentives align executives with shareholder interests. It hasn’t been until the past couple of decades that private companies have implemented LTIPs to align executives' interests with the long-term success of the company, but also almost out of necessity to compete for the same talent who might already possess an LTIP as part of their compensation. What Are Long-Term Incentive Plans (LTIPs)? Long-Term Incentive Plans (LTIPs) are compensation structures designed to reward executives for achieving long-term business goals. Unlike annual bonuses, which are typically tied to short-term financial metrics, LTIPs are structured to reward performance over a longer time horizon—usually three to five years or more. The primary purpose of LTIPs is to ensure that executives are motivated to focus on sustainable growth, value creation, and the long-term health of the company. The Factors Driving the Adoption of LTIPs in Private Companies According to a survey by WorldatWork, approximately 63% of private companies are using LTIPs as a means of rewarding executives and aligning their interests with the company’s long-term success. Several factors have contributed to the rise in popularity of LTIPs in private companies, ranging from the quest for competitive advantage to changes in organizational dynamics and evolving employee expectations. But the following reasons might shed additional insight: Companies with LTIPs Have 30% Higher Revenue Growth: Research by the National Center for Employee Ownership (NCEO) found that companies that implement equity-based LTIPs experience 30% higher revenue growth compared to those that do not. The statistic underscores the positive impact of LTIPs on a company’s overall performance, as they drive executive focus on achieving goals that lead to sustained revenue growth, innovation, and market expansion. 91% of Executives in Private Companies Cite LTIPs as Key to Retention: A survey by Korn Ferry found that 91% of executives in privately held companies consider LTIPs an essential factor in their decision to stay with the company. The statistics demonstrate the significant role LTIPs play in retaining key talent, ensuring that executives are motivated to stay with the company over the long term. By offering equity-based compensation, companies can reduce turnover and keep their leadership team focused on long-term objectives. Companies With LTIPs Are 50% More Likely to Meet Exit Targets: According to a report by Bain & Company, private companies that implement LTIPs are 50% more likely to meet or exceed their exit targets during mergers, acquisitions, or initial public offerings (IPOs). By aligning executives' interests with long-term value creation, LTIPs motivate leadership to work toward achieving the performance metrics that will maximize the company’s value at the time of sale or public offering. Transitioning Ownership and Succession Planning: For family-owned businesses or privately held companies with a significant ownership stake held by a small group, succession planning is another critical factor in the decision to adopt LTIPs. As the company grows and the leadership team evolves, there may be a need to transition ownership to new management. LTIPs can help retain key executives during this period of change, providing financial incentives that keep the team focused on the company’s long-term growth even during periods of uncertainty. As businesses strive to remain competitive and evolve in an increasingly dynamic marketplace, the adoption of LTIPs has evolved as a key driver for optimizing performance. No longer limited to public companies; private companies have increasingly recognized the benefit and need for these compensation structures. Perhaps adding these 4 simple letters (L-T-I-P) to a company’s compensation program could be the difference maker that they’ve been looking for.

Assistant General Counsel With roots going back to the 1960’s, Forest City Trading Group (FCTG), may have started as a small lumber yard run by two immigrant brothers, but has since grown into North America’s largest wholesale lumber product distributor. FCTG facilitates the distribution of products across 6 continents through our network of 12 operating companies and over 800 employees. The company’s impact is far-reaching, especially when considering that one in every ten houses today is built using products sourced and sold by our operating companies. As proponents of forest sustainability, FCTG actively supports suppliers who use sustainable forest management practices that promote forest sustainability and result in long-term environmental, social, and economic benefits. Due to significant growth over the last decade, and expecting strong growth in years to come, FCTG is adding an Assistant General Counsel to their legal team to support growth and help scale the business. Position Overview Forest City Trading Group is seeking a highly motivated and skilled Assistant General Counsel to report directly to, and support, the General Counsel and assist in managing the company's legal operations. The ideal candidate will have strong legal expertise, excellent communication skills, and the ability to collaborate effectively across different business units. This position offers an exciting opportunity to be a part of a dynamic team while contributing to the growth and success of the company. Key Responsibilities Provide legal support to the General Counsel on a variety of corporate, commercial, regulatory, and operational matters. Assist in the company's legal department operations, including document management, contract review and negotiation, legal strategy, and corporate governance. Draft, review, and negotiate contracts, agreements, and other legal documents to ensure compliance with applicable laws and regulations. Assist with the management of corporate compliance and risk management programs, including conducting legal risk assessments and providing recommendations for mitigation. Collaborate with cross-functional teams (e.g., finance, IT, human resources, marketing, trading operations) to provide legal guidance on operational and business issues. Advise on employment law matters, including policies, employee relations, and compliance with federal and state employment laws. Handle legal research and due diligence for mergers, acquisitions, and other corporate transactions as needed. Manage outside counsel and vendors, ensuring legal matters are handled efficiently and cost-effectively. Assist with litigation and dispute resolution matters, including managing internal investigations, handling settlement negotiations, and overseeing litigation strategy. Stay updated on legal developments and regulatory changes that may impact the company’s operations and provide proactive legal solutions. Qualifications and Skills Juris Doctor (JD) degree from an accredited law school. Licensed to practice law in Oregon. Minimum of 5 years of legal experience, with preference for some experience within a corporate or in-house legal environment. Experience in corporate governance, commercial contracts, employment law, and regulatory compliance. Strong analytical skills with the ability to identify and solve complex legal problems. Excellent written and verbal communication skills. Ability to work independently, manage multiple priorities, and maintain a high level of professionalism under pressure. Strong interpersonal skills and the ability to build effective relationships with internal stakeholders at all levels of the organization. Ability to handle confidential and sensitive information with discretion. Preferred Experiences Experience supporting operational functions, such as HR, marketing, and compliance, in a corporate setting. Previous experience managing outside counsel and coordinating legal projects. Experience with construction and material supply contracts. Interested in Learning More? 180one is a retained search firm and has been engaged by Forest City Trading Group to manage this search. If interested in learning more about the opportunity, please contact Lisa Heffernan/ 971.256.3076/ lisa@180one.com

180one is pleased to announce our recent partnership with A-dec and the resulting hire of their SVP of Manufacturing! ABOUT THE COMPANY A-dec is the premium leader in the dental equipment industry designing and manufacturing products that span dental chairs, lights, handpieces, furniture, air management, infection control and delivery systems found in dental offices and operatories. With over 1300 employees, and headquartered in Newberg, Oregon, A-dec’s familial culture and values have been attributed to their commitment to the Newberg community and its employees through various investments and programs. Congratulations to A-dec and the 180one Search Team on a successful executive placement!

CHIEF EXECUTIVE OFFICER ABOUT SKUTT Based in Portland, Oregon, Skutt is the leading manufacturer of kilns and pottery wheels in North America. With the help of over 85 employees, Skutt is committed to building the highest quality products serving schools, hobby and production potters. Skutt ensures the highest level of product quality by investing in its people, equipment and lean manufacturing processes. Skutt firmly believes that happy employees translate into happy customers. Many of Skutt’s team members have been with the company for over 10 years. The equipment used to make heating elements, transform bricks, and build controllers leads the industry in innovation and performance. Skutt knows that great equipment translates into fewer problems and happy customers. Skutt is always striving to give customers more value and better quality which is why all team members (office and plant) have been trained in lean manufacturing practices. Skutt is a family-owned business but is transitioning the leadership of the company to professional executives. Based on this, Skutt is looking for a CEO to continue the legacy in its next chapter of success. HISTORY In 1953 father/son team, Ralph and Neil Skutt, manufactured the industry’s first multi-sided hobby kiln in Olympia, Washington under the name “Skutt & Son”. The introduction of this new lightweight design revolutionized not just the ceramic kiln business but the whole ceramic industry by bringing ceramics to the home. A lot has changed over the last 70+ years. Kiln companies have come and gone, new clay bodies and glazes are constantly being developed that demand greater firing precision, and automatic controllers are quickly replacing the once cutting edge KilnSitter. Throughout the years, Skutt has continued to work hard to meet the changing needs of its customers, but one thing that has remained constant is their fierce dedication to manufacturing quality products and providing outstanding customer service. THE OPPORTUNITY Reporting directly to the Board of Directors, the CEO will be responsible for developing and implementing strategic initiatives, driving operational excellence, and fostering a culture of human development, collaboration, and respect. This role will manage the long-term success of the Company and will work closely with the Board of Directors, senior management team, and external stakeholders to ensure the company’s continued success and profitability. ESSENTIAL DUTIES Assist in the development of, and then execute, the company’s vision, mission, and strategic business plan. Collaborate with the Board of Directors to align company goals and strategies. Inspire, mentor, and lead the senior management team and employee team members. Establish long-term goals to maintain Skutt’s position as a market leader. Identify opportunities for alliances, mergers, partnerships, and investment opportunities. Monitor financial performance and implement strategies to achieve revenue and profitability targets. Expand the company’s market share through targeted sales and marketing initiatives. Build strong relationships with customers, distributors, and industry partners. Represent the company at industry events and conferences. Foster a positive, inclusive, and high-performance workplace culture. Champion professional development and retention initiatives. Manage risks effectively and maintain a strong reputation for integrity. Oversee daily operations and ensure efficiency and effectiveness across all departments. Ensure optimized manufacturing processes and supply chain management to meet quality and delivery standards. Ensure compliance with local, state, and federal regulations, and company policies, procedures, and compliance programs. Work with marketing teams on SKUTT branding, advertising, and marketing campaigns. Maintain knowledge of trends, developments, new technologies, and market conditions relevant to the division and industry. Work with customers/distributors and sales teams on contracts, actively assisting with negotiations. Provide constructive and timely performance evaluations. KNOWLEDGE, SKILLS, & ABILITIES COMMUNICATION: Effectively convey information and ideas through written, verbal, and non-verbal means. RELATIONSHIP BUILDING: Establish and maintain positive relationships with colleagues, customers, and stakeholders. PLANNING AND ORGANIZATION: Develop and implement plans, set priorities, and manage resources to achieve goals. RISK MANAGEMENT: Identify, assess, and mitigate risks to the organization. ANALYTICAL: Analyze data, information, and assess situations to make informed decisions or recommendations. INDUSTRY TRENDS: Build awareness and stay current on emerging trends, products, technologies, and best practices in the industry. STRATEGIC: Analyze the business and make decisions to drive long-term goals and objectives. BUSINESS INTELLIGENCE: Collect, analyze, and interpret data to provide actionable insights for business decision making. CONFLICT MANAGEMENT: Identify, address, and resolve conflicts in a constructive manner to achieve positive outcomes. DELEGATION: Assign tasks and responsibilities to others and hold them accountable for their performance. QUALIFICATIONS 10+ years of related experience in senior level leadership roles. Previous experience in product or manufacturing companies is preferred. Strong team leader and organizational skills with the added ability to take initiative. Highly organized, accurate, detail and multi-task oriented. Strong verbal and written communication skills. Bachelor’s degree is required. Master’s degree is preferred. Interested in Learning More? 180one has been retained by Skutt Ceramic Products to conduct this search. If interested in learning more about the opportunity, please contact Rochelle Fleischer at rochelle@180one.com / 503.699.0184

Vice President of People Services ABOUT THE COMPANY Every Decision. Every Detail. Every Day. Locally owned since 1886, Lease Crutcher Lewis is a commercial construction company committed to making a positive impact for their clients and the community they build in. At Lewis, where every employee is an owner, their people are empowered to make decisions – big and small – to meet the goals of their clients. They understand that in construction even the smallest of details affect the integrity of the work and the safety of their sites. That’s why their teams are tenacious when it comes to getting it right, day in and day out, to deliver quality buildings that stand the test of time. With personal fulfillment as one of their six core values, Lewis has a collaborative and supportive culture committed to the success and development of their people. A few notable projects which highlight their expertise in delivering high-quality, innovative projects for their clients include: The Rainier Square Tower in downtown Seattle; the Oregon Zoo Elephant Lands and the Cedarbrook Lodge . ABOUT THE ROLE The VP of People Services will serve as a strategic partner to the executive team, aligning people strategies with organizational goals to drive growth, innovation, and cultural excellence. This role will lead the charge in creating a supportive, inclusive and collaborative workplace across all levels of the organization. With a focus on scaling talent acquisition, retention, and development programs, the VP of People Services will leverage data-driven insights and innovative approaches to enhance workforce planning, performance management, and overall organizational health. In addition to driving strategic priorities, this role will act as a trusted coach and mentor, empowering the People Services team to support employees and leaders effectively. They will prioritize people over processes, ensuring a culture that values empathy, authenticity, and connection. This role requires a visionary leader who can navigate the complexities of a multi-state and unionized environment while designing actionable solutions to HR challenges and continuously adapting to evolving business needs. PRIMARY FUNCTIONS & ESSENTIAL RESPONSIBILITIES Strategic Leadership : Serve as a key advisor to the CEO and executive leadership, aligning people strategies with organizational goals and fostering a culture of performance and inclusion. Align People Strategies: Collaborate with executive leadership to develop and implement People Services and Learning and Development strategies that support business objectives, drive growth, and enhance organizational effectiveness. Foster Inclusive Culture: Champion inclusion initiatives to create a workplace where all employees feel valued, engaged, and empowered to perform at their best. Support Decision-Making: Provide data-driven insights and recommendations on workforce trends, talent acquisition, compensation, and retention to inform strategic planning and executive decision-making. Drive Performance Excellence: Partner with leadership to design and execute initiatives that build leadership capacity, enhance team performance, and cultivate a culture of accountability and innovation. Utilize the Lewis Leadership Development Program’s (5) Pillars and corresponding competencies as guidelines. Performance and Talent Management : Develop and oversee the implementation and execution of an evolved performance management process. Further integrate learning and development programs to create a wholistic approach to talent management. Enhance Performance Processes: Develop and manage performance management systems that align individual and team goals with organizational priorities, ensuring continuous improvement and accountability. Integrate Learning and Development: Implement strategies to seamlessly connect performance management with learning and development programs, fostering a comprehensive and continuous approach to talent growth and retention. Support CEO in the ongoing development and implementation of the Lewis Leadership Development Program (LLDP). Support Leadership Development: Support the identification and cultivation of high-potential talent through targeted learning and development and succession planning programs. Utilize Data-Driven Insights: Leverage performance metrics and feedback to refine learning and development programs, address skill gaps, and drive organizational excellence. Employee Engagement: Develop and implement employee engagement strategies to reinforce Lewis’ Purpose, Values and Culture. Consult on elements of effective communication (w/ VP of MarComm), recognition programs (w/ CEO), and opportunities for growth and connection (w/ Department & Operations Leaders) to enhance employee satisfaction, and drive engagement. Reinforce Purpose and Values: Develop engagement initiatives that align with Lewis’ Purpose, Values, and Culture, fostering a sense of belonging and shared mission among employees. Drive Employee Satisfaction: Implement programs to enhance satisfaction and morale through effective communication, meaningful recognition, and responsive leadership. Foster Connection and Growth: Create opportunities for employees to build relationships, develop professionally, and contribute to organizational success through tailored engagement strategies. Measure and Improve Engagement: Utilize surveys, feedback tools, and data analysis to monitor engagement levels and refine strategies to address evolving workforce needs. Total Rewards and Compliance : Ensure Lewis provides competitive compensation and benefits programs, maintains compliance with employment laws, and promote an equitable and inclusive workplace. Administer Competitive Rewards: Design and manage compensation and benefits programs and systems to attract, retain, and motivate top talent while aligning with market benchmarks. Ensure Legal Compliance: Monitor and enforce compliance with federal, state, and local employment laws, ensuring HR practices meet regulatory standards. Navigate Complex Union Agreements: Collaborate with leadership to address significant employment matters related to multi-geography operations and other scenarios not covered by existing union agreements, ensuring compliance and alignment with organizational goals. Promote Equity: Develop policies and programs that foster pay equity and transparency across all levels of the organization. Evaluate and Adapt Programs: Regularly assess the effectiveness of total rewards offerings, leveraging employee feedback and market data to make improvements that align with Lewis' goals and values. Department Leadership Attracts, develops, and retains a professional, high-performing People Services team in alignment with Lewis current needs and future strategic plan. Provides leadership and management direction; cultivate strong collaboration and teamwork within the team; ensure high performance through skill development, formal and informal coaching, growth assignments, and performance feedback. Provides guidance and support to ensure team develops and manages effective cross-functional relationships in a multi-stakeholder environment. SKILLS, KNOWLEDGE, QUALIFICATIONS AND EXPERIENCE Bachelor’s degree or equivalent required. Minimum 15 years of HR experience, and minimum of five years of leading HR teams. Ability to lead a functional group to high-performance; ability to think strategically and operationalize the strategy into the daily tactics of the organization. Strong strategic planning, problem solving, and client orientation skills combined with a proven record of leading change in an ambiguous and complex environment. Consultative and analytical mindset, with the ability to influence leaders and achieve results, including in areas without direct responsibility. Ability to provide quantitative and qualitative data/analysis to drive decision-making; excellent stakeholder and program/project management experience. Strong comfort with technology and proven ability to implement modern People Services and Learning technologies and solutions. Demonstrated ability to effectively communicate with, and influence, all levels of management and employees; ability to engender trust and respect of employees at all levels. Excellent verbal and written communication skills; highly organized, self-starter; and demonstrates good judgment in protecting confidential information and uses discretion in discussing sensitive issues. Good negotiation, communication and conflict-resolution skills; ability to represent Lewis in negotiations with external agencies, vendors and partners. Interested in Learning More? 180one is a retained search firm and has been engaged by Lease Crutcher Lewis to manage this search. If interested in learning more about the opportunity, please contact Tom Haley /503.334.1350/ tom@180one.com

180one is pleased to announce our recent partnership with Columbia Distributing and the resulting placement of their new Chief People Officer! In 2008, Columbia Distributing, Mt. Hood Beverage, and Gold River Distributing united to form Columbia Distributing as we know it today. With this merger and the 2018 acquisitions of Marine View Beverage and General Distributors, Inc., our company is now one of the Top 5 largest beer/wine distributors in the US. Size is not our only distinction, however, as Columbia Distributing boasts an extensive selection of beverages, including craft beer, wine and spirits. Columbia Distributing’s success lies in the teamwork of the roughly 3,000 employees spread throughout 27 locations in Oregon and Washington, who every day come together to execute on a common vision. Congratulations to Columbia Distributing, and the 180one Search Team on a successful executive placement!