Breaking Down the Recruiting Brick Wall: Evaluating & Selecting Candidates

This article is the last in a three-part series looking at how your organization can improve its hiring processes. Just joining us? Read parts one and two to learn about creating your success profile and sourcing candidates for your positions.

In Post 2 in our series “Breaking Down the Recruiting Brick Wall: How to Build More Effective Hiring Practices,” we shared a few active ways to go beyond your standard job postings and effectively source and recruit the right candidates for your organization.

Now that you know how to identify the top candidates for your pipeline, how will you evaluate them properly in order to make the best hire possible?

To assess candidates, your organization may follow standard practices such as reviewing resumes to look for at least the minimum qualifications; bringing qualified candidates through an interview process; or conducting reference checks with candidates’ former employers.

Many organizations often believe using one or two of these practices will be enough to decide whether a candidate is the right fit. But, rather than relying on a face-to-face interview or a reference check, putting together all of these practices (and more) will better allow you to gain a truer picture of who a candidate really is and how they will fit in at your organization.

Today we’ll help you take your core candidate evaluation practices to the next level and show you how to combine interviews, reference checks and other assessment tools to increase your chances of making a great hire.

Remember Your Candidate Success Profile

Before you begin evaluating candidates, refer back to the Candidate Success Profile we discussed in Post 1 to know what to look for when reviewing resumes, what to address with interview questions, etc. Like with the other steps in your hiring process, using the Success Profile as the foundation for your assessment process will ensure you choose the candidate with the right hard and soft skills needed in order to succeed in the role.

Nail the Interview

How would you rate your interview process? How would candidates rate it? A strong and consistent interview strategy is critical in evaluating candidates. Here are a few things to consider when putting yours together.

The Interview Team

Who from your organization will interview candidates? Should candidates meet with everyone in the first round, or will interviewers meet with candidates at different stages of the process? And will the interviews be cross-functional, or will candidates only meet with members of the hiring department?

Decide on the size and scope of your interview team at the beginning of the process, and follow the same interview structure and schedule with each candidate you bring through the interviews.

Maintaining a consistent interview team makes it easier to ensure that everyone involved in this stage understands the needs of the role and the qualifications you are seeking in a candidate. Logistically, keeping your interview team consistent can also make scheduling interviews go more smoothly, which will help you move quickly with candidates and maintain search momentum.

The Interview Questions

Use your Success Profile to develop questions that address the key areas you’ve identified that a candidate will need to excel in this role. Consider assigning specific skillsets for individual interviewers to focus on based on their respective areas. For example, a member of your finance team could assess the candidate’s analytical competence while a human resources professional evaluates cultural fit. You should also make sure to keep questions open-ended.

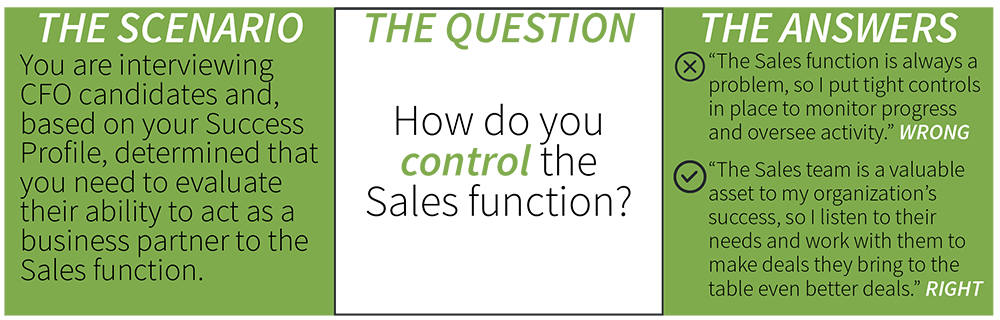

Ultimately, you want to design questions that will prompt candidates to provide specific examples relating back to the Success Profile or allowing you to observe their skills in action. Below is an example of what we’re talking about.

How you word your interview questions is crucial in eliciting an answer that gives you a better picture of the candidate’s views and working styles. In the scenario above, the word “control” baits the candidates, enabling you to figure out if and how they are able to partner across functions within your organization.

Scenario-Based Work Examples

Another way to evaluate candidates’ fit during the interview process is to assign a project to complete prior to your in-person meeting with them. These scenario-based work examples allow you to assess hard and soft skills that may be challenging to evaluate with questions alone.

For example, if filling a marketing position, you could ask candidates to develop a go-to-market strategy for a new product launch to present at their in-person interview. An assignment like this can allow you to see not only how candidates think strategically and creatively but also their ability to present to a leadership team.

Remember that these assignments or projects should also be based on the Success Profile; if “strong presentation skills” are not a key area you outlined, developing a way to evaluate this attribute would be irrelevant to your interview process.

2 More Tools to Help You Determine Who the Candidate Is

Psychometric Assessments

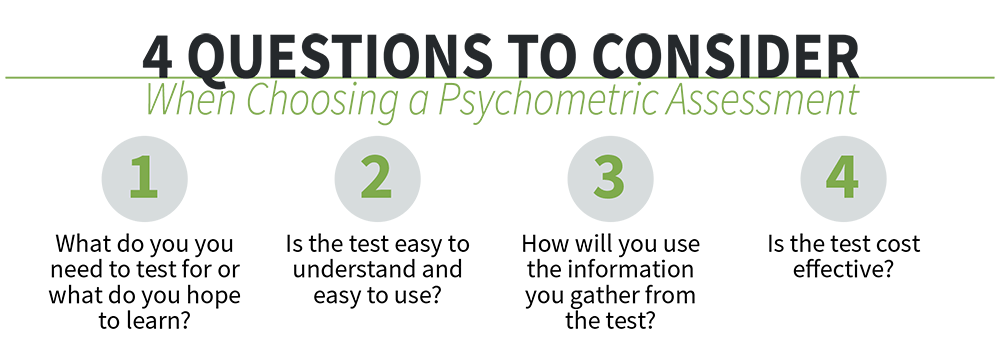

Many of our clients use assessments such as DiSC, Personalysis, MBTI and StrengthsFinder as evaluation tools when selecting new team members.

These tools measure an array of individual attributes, including behavior & personality, skills & competencies, emotional intelligence, motivators and values. And they aren’t just used for recruiting and hiring; many assessment suites include tests that address individual development & team building, job analysis & benchmarking, performance management and more.

Psychometric assessments can be valuable to an organization’s development and people management strategies, but they are more effective when you invest in them across your organization; rather than using an assessment for a single hire, you should adopt it for all current and new employees in order to assess your organization as a whole and maintain consistency going forward.

You will also need a trained facilitator to administer the test and interpret the results. If you aren’t ready to commit internal resources yet, engage a consultant who specializes in one or more assessment tools to oversee this process.

At 180one, we are big fans of incorporating these types of tests into your overall assessment approach, but remember that these tools are just one piece of your entire evaluation process and should not be considered “hire or not hire” tests.

Reference Checks

Most organizations conduct reference checks during the hiring process, but do you know how to make the references you receive more effective in assessing a candidate? Here are a couple of tips to help you improve your reference checks.

Ask the candidate for the

right references.

The quality and reliability of your reference checks rely first on where the references come from. Again, refer back to your Success Profile as a reminder for exactly what you are looking for and determine who you need to talk to in order to learn more about how a candidate satisfies those key areas.

Hiring for a leadership position? Conduct a “360 Review” by having candidates provide you someone they report to, someone who reports to them and someone who is a peer to them to serve as references.

Rather than the candidate selecting the references to check, you could also specifically ask to speak to a former boss at ABC Company; how the candidate responds to this request will also be very telling in evaluating their fit for your organization.

Ask the references the

right questions.

Like with interview questions you ask a candidate, questions for reference checks require finessing in order to draw out responses that will be useful in evaluating the candidate.

Need to know in what areas a candidate may be weak? Rather than asking, “What is the candidate’s biggest weakness?” ask a reference, “How can we help develop the candidate?” for a more honest and authentic response.

Putting All of the Pieces Together

After collecting information about your candidates through various channels (resumes, interviews, assessments, references, etc.), how do you use that data to help you make a hiring decision?

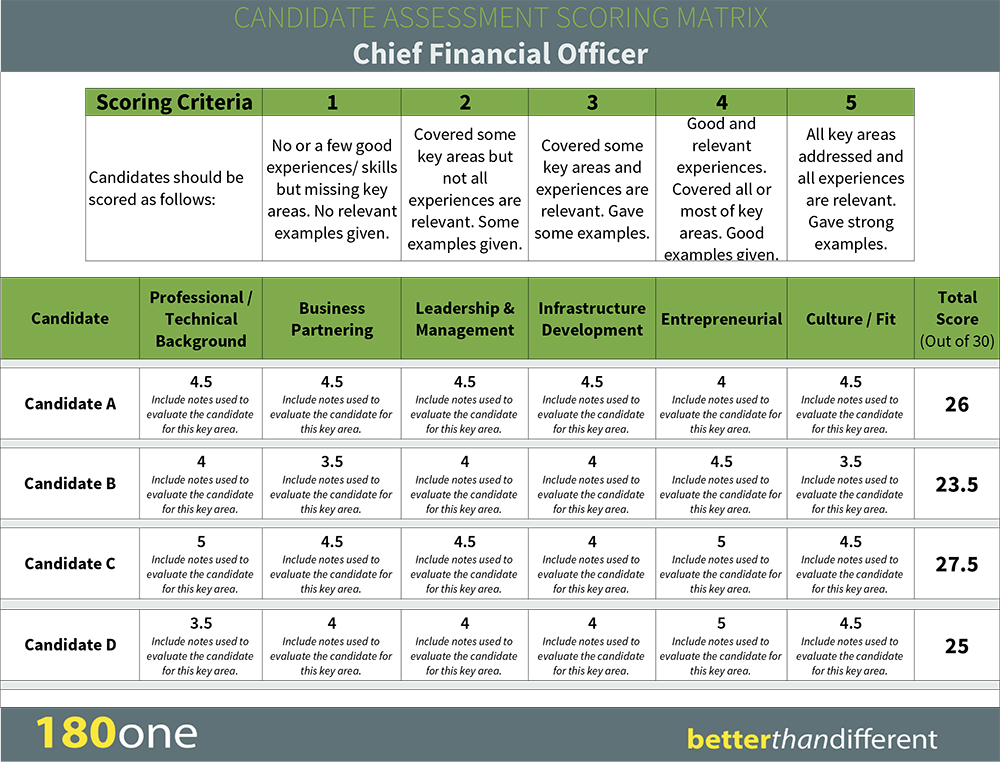

A pragmatic approach to evaluate candidates consists of developing a simple ranking system to see how their skills and fit stack up.

Create a Candidate Assessment Scoring Matrix and rank every candidate using a numeric scale on how well they meet the criteria laid out in your Success Profile.

Make sure you have the evidence to support your rankings, though. If you didn’t assess a candidate’s leadership qualities in the interview, psychometric assessment or reference check, for instance, do not assume that they are a leader just because they have that title at their current organization.

Here is an example of a simple Scoring Matrix to give you an idea.

In the end, you want to feel confident in your hiring decision, and laying all of the information you gathered out in a Scoring Matrix will take the guesswork out of deciding whether a candidate is the best choice for the role and for your organization.

A Final Recap of the “Breaking Down the Recruiting Wall” Series

Much of the conversation about what makes a company successful today centers on one main thing: its people. But, while hiring and cultivating top talent is a priority for most organizations, many companies still lag behind when it comes to investing in sourcing, recruiting and assessing new candidates.

Over the past few months, 180one has provided insight into the marketplace and tips and strategies for how to up-level your company’s hiring practices so you can start “walking the walk” and investing more in your people.

After reading the “Breaking Down the Recruiting Brick Wall” series, you are now equipped to:

- Build a strong foundation for your recruiting and hiring processes by knowing what you’re looking for when it comes to the ideal candidate for a position and your organization

- Take a more active and creative approach to sourcing new talent by posting jobs more strategically, leveraging the media to promote your open positions, targeting specific candidates & companies and more

- Redevelop your assessment process to more accurately evaluate and select the right candidates for your organization

Of course, elevating your entire hiring process may sound like a daunting task, but this is why the retained recruiting industry exists. For organizations that aren’t ready to overhaul their systems or don’t have all of the pieces in place yet internally, a retained search firm like 180one can provide the resources, experience and know-how to find the candidates who will succeed in the most challenging roles.

Ultimately, your people are your best asset, so there is no reason why you shouldn’t start investing in finding the right professionals for your organization today.