Inside-Out: Developing a More Diverse Workforce From Within

Today’s post on The Water Cooler tackles the gigantic issue of diversity in the technology industry. While tech companies from Silicon Valley to the Silicon Forest to Seattle are adopting strategies to increase diversity in the industry, how can internally developing employees help the industry solve the diversity problem?

First, take a good, hard look at developing internal talent. Here’s a lesson in professional development from Walt Disney, one of the 20th century’s most iconic businessmen and innovators.

How Walt Disney Used Talent Development to Win at Animation

The production of Bambi (1942) is one of many examples in which Disney, instead of going to outside sources to solve creative problems, chose to develop his existing animators in order to raise the bar in animation. Despite being a difficult feature to get rolling, Bambi marked an incredible achievement of resource development for the Studios. Disney wanted the animals to move realistically, as animals would move in their natural habitats, which had never been done before.

Instead of approaching the situation by looking to hire someone with that established skillset, Walt Disney sent his animators to art school in the evenings to hone their craft, and brought in live animals, including deer and raccoons, to the studio for them to study. These professional development initiatives enabled Disney’s animators to achieve realistic movement in the characters of Bambi. Retrospectively, Bambi is lauded as an animated achievement, and marked the first on-screen credit to Retta Scott, the Studios’ first female animator, who was brought onto the project because of her skilled charcoal sketches. Through this example of Disney’s utilization of professional development, and his ability to recognize and develop the skillsets in his team that were needed to complete the film, Bambi transitioned from a problem production, to an animated achievement.

The story of Walt Disney and Bambi shows us that internal investments pay dividends in achieving innovation. Now what can talent development do to help the diversity gap plaguing the tech industry?

But First, That Diversity Gap

The lack of diversity (in both race and gender) in one of the nation’s fastest-growing industries is not just a Silicon Valley problem, as the Silicon Forest is also experiencing a lack of gender diversity in Portland’s tech scene. When it comes to women in tech, Portland has a “a gender pay gap of 80.1 percent and only 24 percent of tech jobs filled by women.” Nationally, numbers for women in tech aren’t looking so great either. In 2015, women made up 25 percent of computing-related occupations, with only 9 percent of those women being women of color, according to a study done by the National Center for Women in Information-Technology.

For tech-giant Intel, the company found that the numbers weren’t pretty either. Furthermore, they realized that simply releasing data on the company’s diversity was not enough to bring about actionable change. However, Intel took it further and “set ambitious diversity goals, and tied managers’ bonuses to them. Intel also stated it would become the first high technology company to achieve ‘full representation’ of women and underrepresented minorities by 2020,” quoted in an April 2016 article by Inc. It’s important to note that “full representation” doesn’t necessarily mean 50 percent men and 50 percent women, either – Intel clarified in their goals that full representation meant “reflecting the available talent marketplace for the groups and businesses in which you hire,” which for women is still only 27 percent.

While Intel has made serious strides in improving diversity in the workplace (43% of last year’s hires qualified as diverse hires), this surfaces the question plaguing the technology industry: How do companies then not only tap into the available talent marketplace of diverse hires, but rather what can they do to develop and increase that talent pool beyond the existing 27%? Arguably, going above and beyond by implementing strategies to move the needle and achieve more than 27% representation for women in technology, could very well position companies in a proactive position to considerably alter the landscape (and reputation) of the industry for the better.

Recruiting for a More Diverse Workforce

For many technology companies, including giants Intel and Microsoft, the strategy of achieving “full representation” relies heavily on reformed recruiting and hiring. A variety of technology companies have identified more proactive strategies that help them operate more inclusively within recruiting and hiring. Microsoft, for example, recruits from a wide breadth of conferences and events that are inclusive. Adopting more inclusive language into job descriptions is also a strategy companies are adopting. Social media technology company Buffer found that removing the word “hacker” from their engineering job descriptions made their applicant pool more inclusive. Additionally, organizations are crafting more diverse panels of interviewers; it’s required by Intel that each open position has a diverse slate of candidates and a diverse interviewing committee.

Retention Is Key!

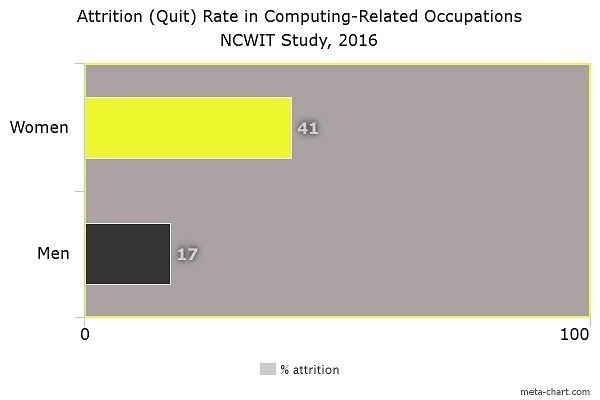

Once diverse hires have been made, retention is a struggle. Additionally, it doesn’t help if organizations are in metro areas that already struggle with diversity, regardless of industry. In a 2016 Metro report, only one-quarter of Clackamas and Washington counties identify as a race other than white, which in turn increases the competition when hiring diverse talent. When one company comes out on “the winning end” or is hiring diverse talent, other companies take notice and poach that talent, leading to a huge problem facing diversity in tech. Instead of poaching, companies should find ways to retain and develop the diverse talent they have, and invest in professional development, as it has been shown to alleviate some of the staggering attrition rates for the diverse talent pool in technology. For engineering specifically, the National Center for Women in Information- Technology found that the attrition or “quit” rate was 40%, with an overall average of 41% across all computing-related occupations – compared to just 17% for men.

This data suggests that in addition to women only representing barely a quarter of the engineering and computing-related workforce, nearly half of those women are choosing to quit. Why? NCWIT’s study found that “women who left were less likely to report opportunities for training and development, support from a manager, and support for balancing work and other competing responsibilities.”

A More Diverse Workforce Begins From Within

For organizations large and small, investing in existing talent is a great way to not only retain employees, but also maintain attractiveness to potential candidates. An impactful strategy exists in identifying potential in your current team and giving your employees opportunities to shine and develop skillsets that may otherwise be outside of their normal job. Developing internal tools, such as behavioral assessments, to gauge this type of potential can lead to exponential employee development. These approaches of investing in talent you already have goes back to the earlier example of Walt Disney’s approach to professional development – giving existing employees additional tools to succeed and grow professionally. NCWIT’s report found that “technical women identify isolation from a lack of mentorship or sponsorship as one of the key barriers to their retention and advancement.” It was also discovered that with mentorship or sponsorship, women’s access to high-visibility work, as well as their promotion and retention rates, rises. The same was true for men, so mentorship and sponsorship can be considered a professional development win-win company wide.

To support talent development initiatives for organization-wide inclusivity, organizations must have a working environment that will support these initiatives. This is an element deemed critical by the NCWIT, which stresses that creating a more inclusive organization should include establishing top leadership support, institutional accountability, and improving managerial relationships. Note that this type of organizational change, from the inside-out, isn’t just advantageous to minority groups, it also benefits majority groups as well. Giving majority groups the opportunity to become allies in the initiative for a more diverse workplace benefits the organization as a whole.

Moving the Needle toward a More Diverse Workforce

While taking proactive approaches through recruiting practices is helping to chip away at the diversity gap in the technology industry, companies should place more emphasis on more inclusive efforts internally to develop and retain talent to truly see growth of the overall diverse pool. While poaching is a short term solution that helps one organization, companies must work together to develop talent in order to help grow the talent pool in its entirety so the industry can see meaningful change. Some great sources for beginning the discussion in your organization can be found through National Center for Women in Information Technology, Microsoft’s Center for Diversity and Inclusion, and Lean In, a resource for women in the corporate workforce. Additionally, if you’re in Portland, take some time to check out Techtown Portland, an organization dedicated to addressing the changing landscape of the Silicon Forest, and proactively addressing representation of women and communities of color in the tech industry. While these changes will take time, starting from within, and then working collaboratively to help close the diversity gap is a huge step in the right direction.